Lots of accountants will talk about tax – few offer advanced tax planning and solutions

The truth is that most people, including many accountants, simply do not understand in detail the modern taxation system. As a result they stick to what they know, paying more and more tax every time they are told or asked to. Year after year, the taxman decimates their hard-won income. That’s why it’s such a revelation when we chat with high earners that there are legal alternatives to just paying out more!

Are you looking for the most advanced tax planning and solutions?

When you are asked how much you earn, you will probably quote your gross income. That’s fine, but is it really all yours? Of course it’s not, at every single period of your working life someone wants a slice and first in the queue is the taxman. If you don’t get it right he will charge you a range of taxes on your income, your spending, on property you own, on transactions you make and when you die – he will tax it all over again.

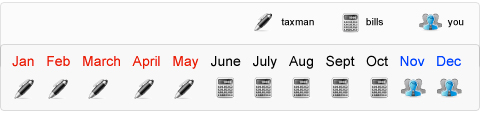

On average it takes from January – May to pay off the taxman

And it doesn’t end there, next are bills including interest and repayments on any borrowing you have. With borrowing at record levels it can take from June – October to earn enough to meet the repayments. Leaving you with 2 months’ money for every 12 months you work.

How you can use advanced tax planning

By working with the tax team at Jacobs Allen you can legally and ethically reduce your tax liability.

Tax planning needs forward, strategic thought to achieve the best outcome. That means we work with you to produce a bespoke solution that helps you move towards your goals, rather than a one-size-fits-all approach that might save tax now but have adverse consequences in the future. It’s how entrepreneurs compound their wealth and make long term decisions that are really tax effective. For example, we have planned to manage a client’s annual income level to save tax of 40%, boosted tax deductible payments into a pension fund to be used tax effectively in future years and produced a planned approach to family giving that eliminated inheritance tax on death. And we represented a client at Tribunal and got HMRC to strike out a liability of £3m after he hadn’t engaged in advance planning with his previous advisers and HMRC investigated him.

If you would prefer to pay less tax, whatever stage you’re at, talk to us now about your advanced tax planning options.